interest tax shield calculator

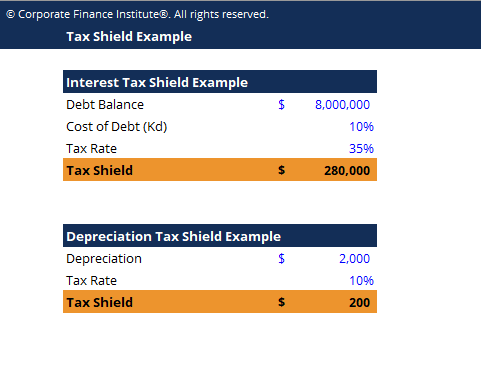

Interest Tax Shield Definition The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. Basically the company uses two main tax shield strategies.

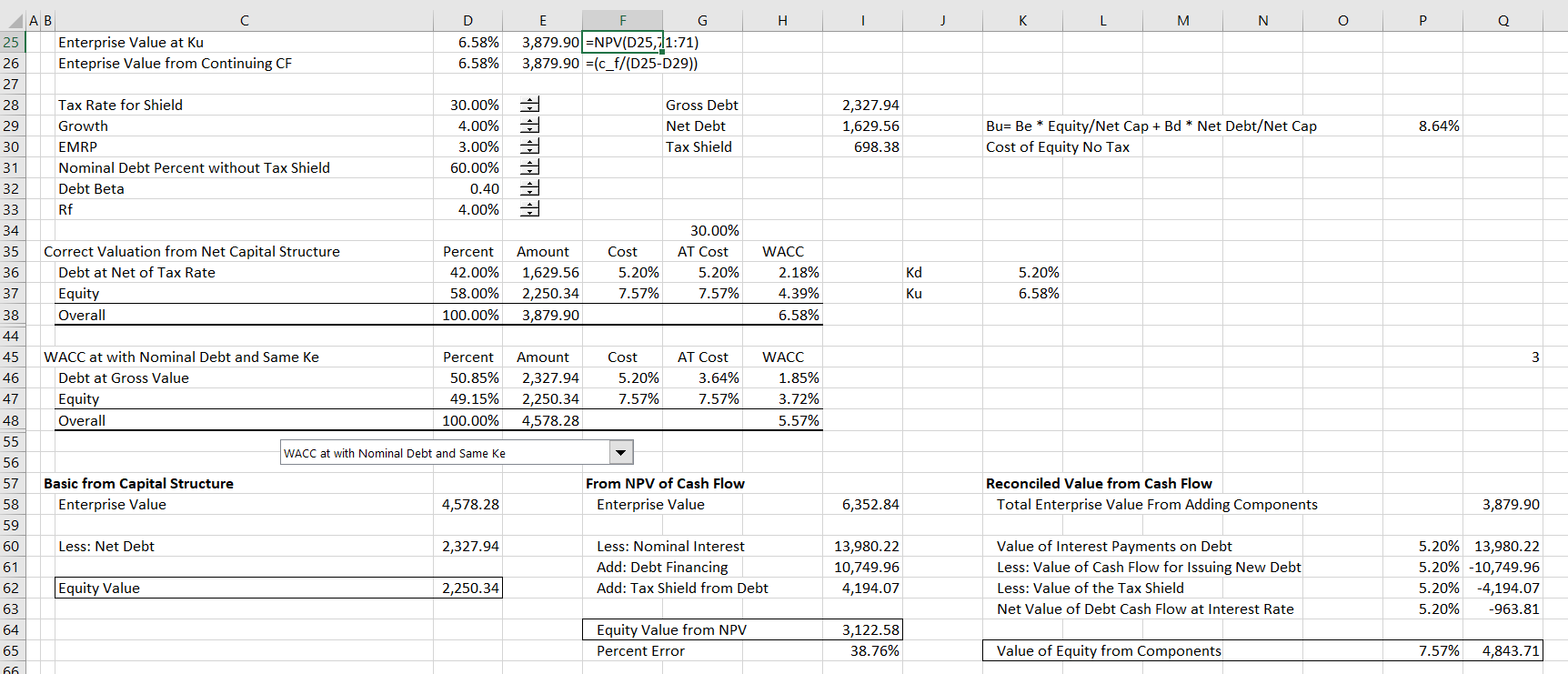

Wacc Adjustment To Correct Valuation Of Tax Shields Edward Bodmer Project And Corporate Finance

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest.

. Cash Outflow in Year 1 Annual repayment Depreciation. It is possible to calculate the value of a tax shelter by multiplying the entire amount of taxable. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedTax shield can be claimed for a charitable contribution.

Interest Tax Shield Definition The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. Without the tax shield Company Bs interest. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest medical expenditure charitable donation.

The tax rate for the company is 30. Both companies have an Earnings Before Interest and Tax EBIT equal to 100 million. Interest Tax Shield 3500 2500 125100.

Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900. A tax shield is a reduction of taxable income due to decreasing it by deductible expenses like interest amortization and depreciation. Adjusted Present Value - APV.

This can lower the effective tax rate of a business or individual which is especially important when their reported. Interest Tax Shield Average debt Cost of debt Tax rate. 02022022 By Carol Daniel Legal advice.

How to calculate the tax shield. How to Calculate Adjusted Present Value APV Since the additional financing benefits are taken into account the primary benefit of the APV approach is that the economic benefits stemming. To calculate the value of the interest tax shield you may use this interest tax shield calculator or estimate the value manually as we do in the following example.

Interest Tax Shield is defined as follows. The impact of adding removing a tax. Those deductions lower the company or.

So the total tax shied or tax savings available to the. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. The extent of tax shield varies from nation to nation and as such their benefits also vary based on the overall tax rate.

What is the formula for tax shield. And an interest expense of 10 million. For instance if the tax.

Formula to Calculate Tax Shield Depreciation Interest The term Tax Shield refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed. The intent of a tax shield is to defer or eliminate a tax liability. For instance if the tax.

The adjusted present value is the net present value NPV of a project or company if financed solely by equity plus the present value PV of any.

Tax Shield Formula Examples Interest Depreciation Tax Deductible

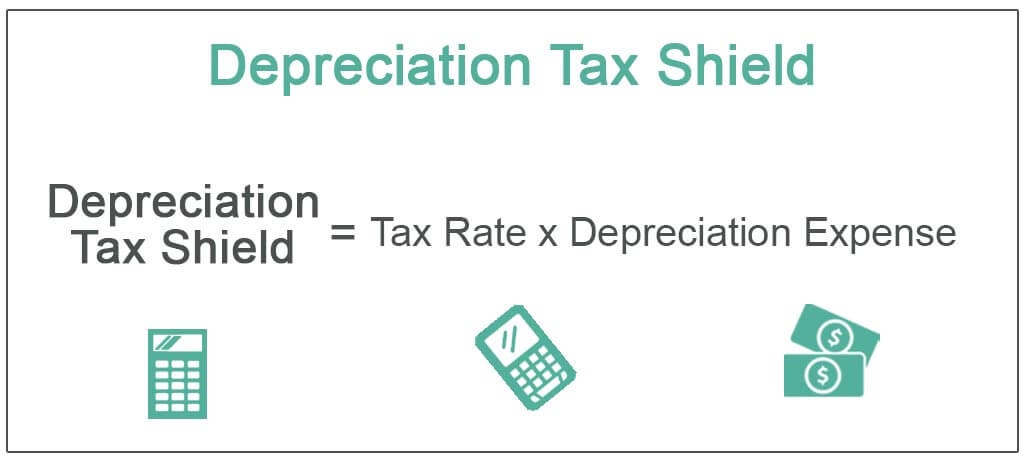

Depreciation Tax Shield Formula Examples How To Calculate

How Tax Shields Work For Small Businesses In 2022

Interest Tax Shield Formula And Calculator Step By Step

Tax Shield Formula How To Calculate Tax Shield With Example

Wacc Adjustment To Correct Valuation Of Tax Shields Edward Bodmer Project And Corporate Finance

Solved Example Interest Tax Shield Annual Interest Tax Chegg Com

Tax Shield Definition Example How Does It Works

Taxtips Ca 2021 And 2022 Quebec Income Tax And Rrsp Savings Calculator

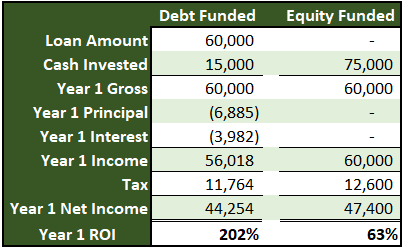

Cima Spreadsheet Skills Debt Sculpting

Discounted Cash Flow Analysis Street Of Walls

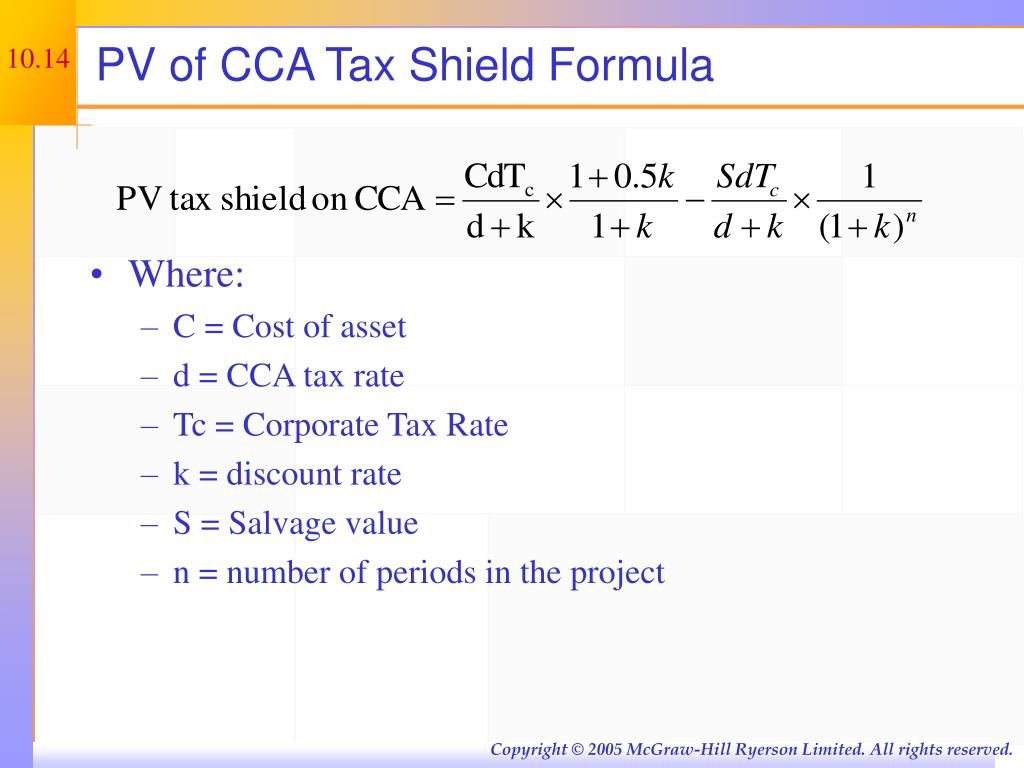

Ppt Making Capital Investment Decisions Powerpoint Presentation Free Download Id 3750664

Risky Tax Shields And Risky Debt An Exploratory Study

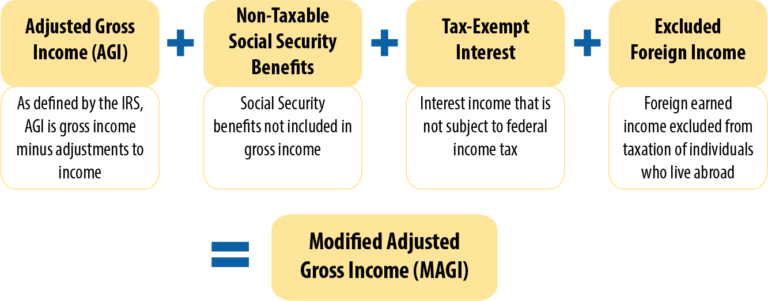

Minnesota Health Network Health Magi Subsidy And Income Information

The Interest Tax Shield Explained On One Page Marco Houweling

Depreciation Tax Shield Calculator Calculator Academy

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Tax Shield Example Template Download Free Excel Template

Calculate The After Tax Cost Of Debt Under Each Of The Following Conditions Interest Rate Tax Rate After Tax Cost 16 41 6 15 22 26 Homework Study Com